The Stakeholder Map — How the Product Field Tells You When To Use It

At Field, we are currently working on Method Advice, a new feature that provides contextual method advice based on the results from the Product Field sense-making process.

Every suggested method will be featured with a how-to guide so even inexperienced product teams can make use of them effectively. To demonstrate the hands-on nature of these method instructions, this post is meant to serve as an example. It offers a slightly abridged version of the guide Field provides to instruct the use of the Stakeholder Map. And in case you're interested in further such examples, there are two more on this blog. One describes the Kano Model, another is a guide to Why/How Laddering.

Stakeholder Map

Stakeholder Maps help identify and classify actors who have power over and/or interest in the outcomes of product development. They help clarify the relationships of internal and external stakeholders to product development, assess their influence, and choose an adequate strategy for managing them.

Result

- A list of relevant stakeholders

- Their classification according to power over and interest in product development

- The identification of adequate management approaches for each stakeholder

Relationship to the Product Field

With Stakeholder Maps you can either identify and fill gaps in the Context layer of your Product Field, or deepen your understanding of and develop adequate strategies for interacting with stakeholders you have already identified in that layer.

It’s especially impactful to use Stakeholder Maps for work on the Drivers area: They help you discover and describe power structures that might strongly influence your project, which enables you to actively manage power holders and anticipate their behavior.

Source

This approach to stakeholder mapping is often called the Power/Interest or Mendelow Matrix and usually attributed to Aubrey L. Mendelow (1991), “Environmental Scanning – The Impact of the Stakeholder Concept”.

In reality, it is an adaptation of Mendelow’s original Power/Dynamism Matrix by Gerry Johnson and Kevan Scholes in their Exploring Corporate Strategy, 3rd ed. 1993 (p. 177). They also introduced a wrong publication year for Mendelow’s paper (it was actually published in 1981, not 1991), which has since been reproduced in virtually every article or book mentioning the Mendelow Matrix.

Newer editions of Exploring Strategy now cite Robert Newcombe (2003), “From client to project stakeholders: a stakeholder mapping approach” as the source for the Matrix, who in turn references the 1993 edition of Exploring Corporate Strategy 🤪. It is a useful reference for the Matrix, though, because it explains and contrasts both the original Power/Dynamism (re-labeled as Power/Predictability) Matrix and the more common Power/Interest Matrix, and illustrates their use with a helpfuf example.

Description

Stakeholder Maps help you identify and prioritise stakeholders and find adequate approaches to managing them. Mapping is best done collaboratively in groups of 3–6 people any may need some preparatory research that looks into all aspects of product development and collects actor information to make sure you don’t miss any relevant stakeholders.

After this preparation, mapping works in the following steps:

Step 1

Start by identifying your potential stakeholders. Think of all the people, groups or organizations affected by or contributing to your product, those who have influence or power over its development, and those who have an interest or concern in its success. Write down their names on sticky notes. Try to be as granular as possible – you want to make sure you’re not missing anyone, and you can always consolidate the list later.

Step 2

Next, cluster the individual stakeholders into groups that share important attributes – e.g. institutional background, specific interests or role in product development – and name these groups. This helps you consolidate – if you realise that individual stakeholders have the same relationship to your product and its development, you can go forward treating them as a group. It also helps you identify gaps – groups or individuals you have so far missed.

Step 3

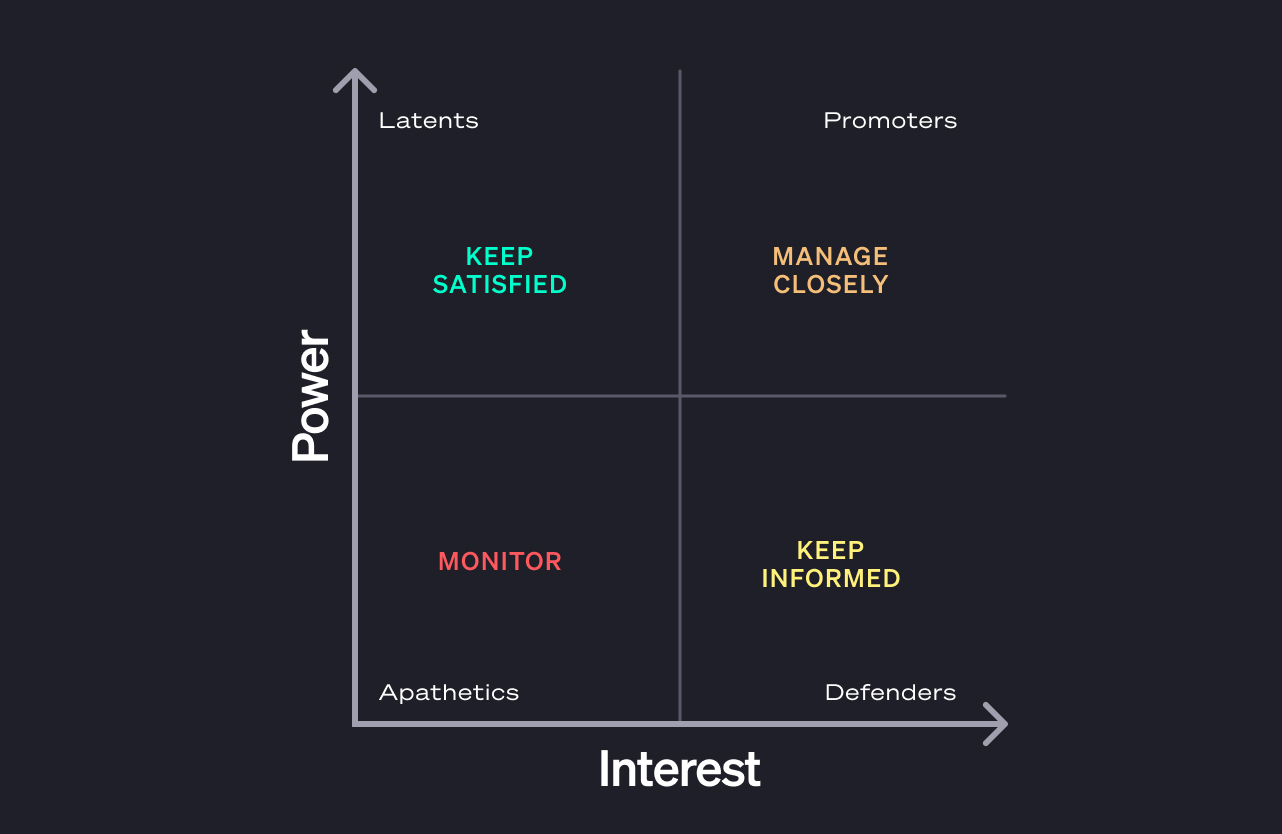

Prioritise the consolidated stakeholders by placing them in the following Power/Interest Matrix and discussing their placement in your group:

High power, high interest

These are the stakeholders that are crucial to your success, as they are affected by it and have the power to influence it. You should fully engage them and make the greatest efforts to meet their needs.

Adequate interaction: Manage Closely

High power, low interest

These stakeholders are potential risks to your success – they aren’t affected by it (or the lack thereof), but can influence it nevertheless. Keep them satisfied, but don’t try to engage them beyond their willingness.

Adequate interaction: Keep Satisfied

Low power, high interest

These stakeholders are affected by what you’re doing, but can’t influence it in relevant ways. Inform and communicate with them to make sure no major issues are arising and to learn from their experience and expectations.

Adequate interaction: Keep Informed

Low power, low interest

These stakeholders are currently neither affected or influential, so don’t put a lot of effort into interactions with them – but make sure you are perceiving any changes in their status, i.e. when they gain power or develop an interest.

Adequate interaction: Monitor

Learn More

Now that you have learned about workings of the Stakeholder Map, and how Field presents method instructions, you might be interested in how Field actually helps teams get to a shared understanding of their situation. How Field helps them facilitate the sense-making process that leads to the contextual method advice.

Start your customized Field trial with one of our product coaches or schedule a personal demo session.